Affordability, Going Out

From a Google Image Search - Taste Cooking

Affordability: Dining Out, Ordering In, Events (e.g. concerts, shows, other events)

One sign of a society that is flourishing is that people living in that society have enough of their needs met that they feel free to go out into their world and seek entertainment. When inflation rises, entertainments are often cut from budgets or become luxury expenses that happen rarely.

Affordability is not just about the price of eggs, beef, or gas. Americans like to have fun. Most Americans work 40-hour weeks and get 2-4 weeks of vacation days a year with some holidays thrown in. We are bombarded with pop culture wisdom about work-life balance. If some Americans tip the scales towards entertainment rather than work, there are many small businesses that exist to cater to these life-is-short folks. However, it seems that inflation is hitting the events people use to decompress after work rather hard.

Dining out and ordering in:

According to Barmetrix,

“Key Takeaways

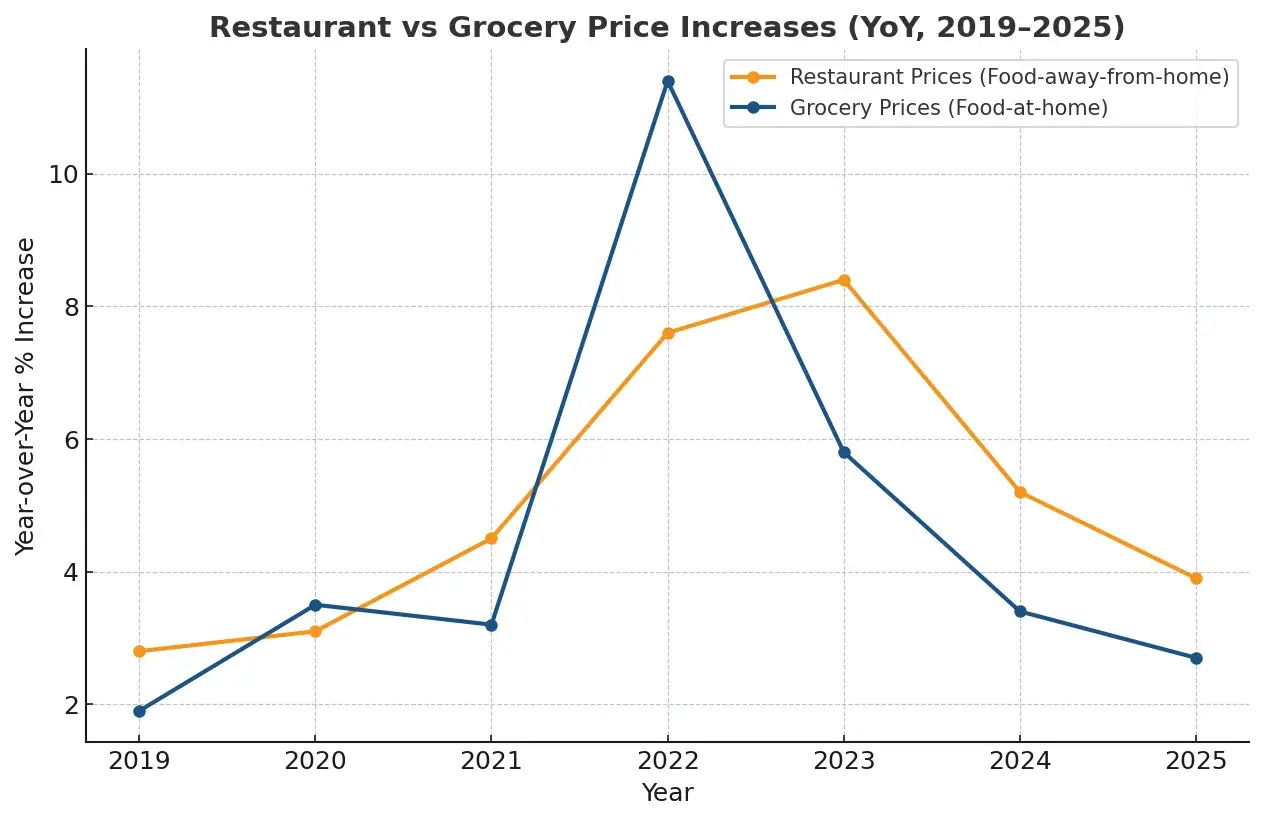

Restaurant prices are rising faster than groceries—guests notice it, and so will your margins.

Since 2019, food and labor costs have each gone up more than 35%, while utilities and swipe fees keep climbing.

Raising prices alone won’t solve it; profitability depends on smarter systems and discipline.

Operators who manage costs, engineer menus, and protect the dining experience will come out ahead.

Guests feel it first at the table. As of August 2025, prices are up 3.9% year-over-year—well above grocery prices at 2.7%. Full-service restaurants have taken the biggest hit, with menu prices rising4.6%.

At the same time, overall guest traffic still hasn’t returned to pre-pandemic levels. For many operators, that means the only realistic way to cover higher input costs is through menu price increases. Chains likeWaffle House have nearly doubled menu prices—but independents don’t have the same brand power or scale to cushion those hikes.

A regular who once ordered their go-to entrée and a cocktail may now skip the drink—or trade the entrée for a cheaper option—when the bill creeps a few dollars higher. For operators, those small shifts add up to thousands in lost revenue over a month.

This article breaks down what “restaurant inflation” really means, how it’s showing up in 2025, and the strategies smart operators are using to protect profit margins without driving guests away.

Key drivers include:

Food costs: Eggs, dairy, proteins, fresh vegetables, and imported goods all contribute.

Labor: Higher minimum wages and staffing shortages continue to push up costs.

Operating expenses: Energy, rent, credit card fees, insurance, and repairs all add to the squeeze.

Supply chain disruptions: Weather, shipping delays, and global instability ripple quickly into invoices.

The squeeze extends well beyond food and labor. Compared with pre-pandemic levels, the National Restaurant Association reports:

Food costs: +35%

Labor costs: +35%

Utility costs: +18%

Occupancy costs: +14%

Other operational expenses (supplies, repairs, credit card processing fees): +22%

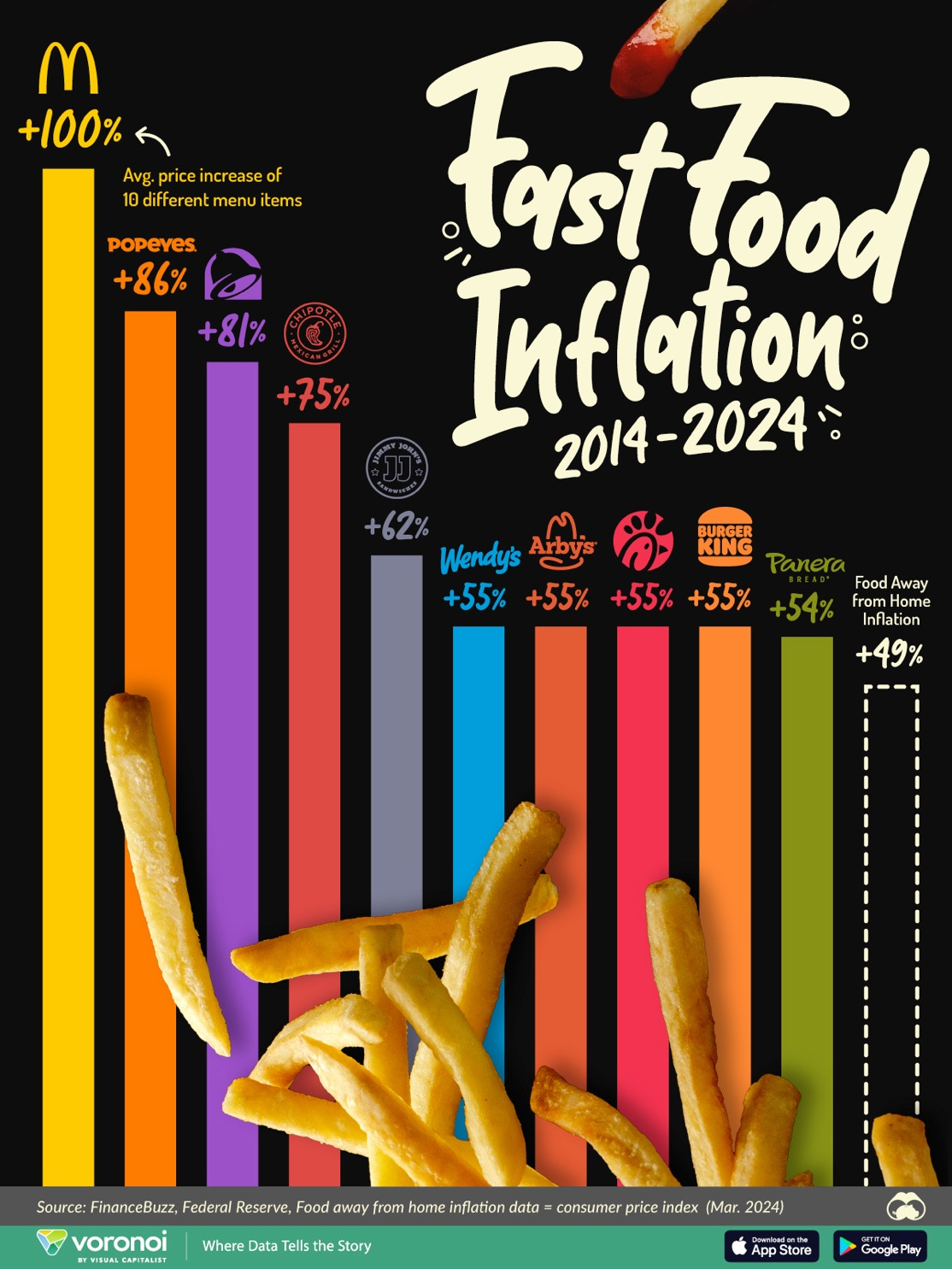

According to the National Restaurant Association, average menu prices have risen 31% since February 2020. Their margin math shows that a 30%+ increase was necessary just to maintain a 5% pre-tax profit margin—not to improve it.

Meanwhile, casual dining chains like Chili’s and Applebee’s have lifted prices steadily each year, while Waffle House has nearly doubled menu prices since 2019. When you don’t have a national brand behind you, those same cost hikes land right on your shoulders.”

https://www.barmetrix.com/blog/restaurant-inflation

From a Google Image Search

If you find that you are experiencing sticker shock when your restaurant tab comes to the table or to the digital payment device, this analysis by the industry backs you up. It is more expensive to dine out than it was. Whether these cost increases can be blamed on Trump, or even on Biden it’s hard to say. This new reality is a post-pandemic scenario. If it began with supply line interruptions, it could be exacerbated by tariffs. Ordering in is even more expensive because of delivery charges. The people who deliver must be paid for their work. The apps must profit from organizing deliveries. Many Americans may find themselves unable to afford enjoying these activities which add variety to days that can feel like ruts. Even people who can afford to eat out, sources say, are dining out less often.

Fast food is not exempt from inflation.

Concerts, Shows, Events

Concerts

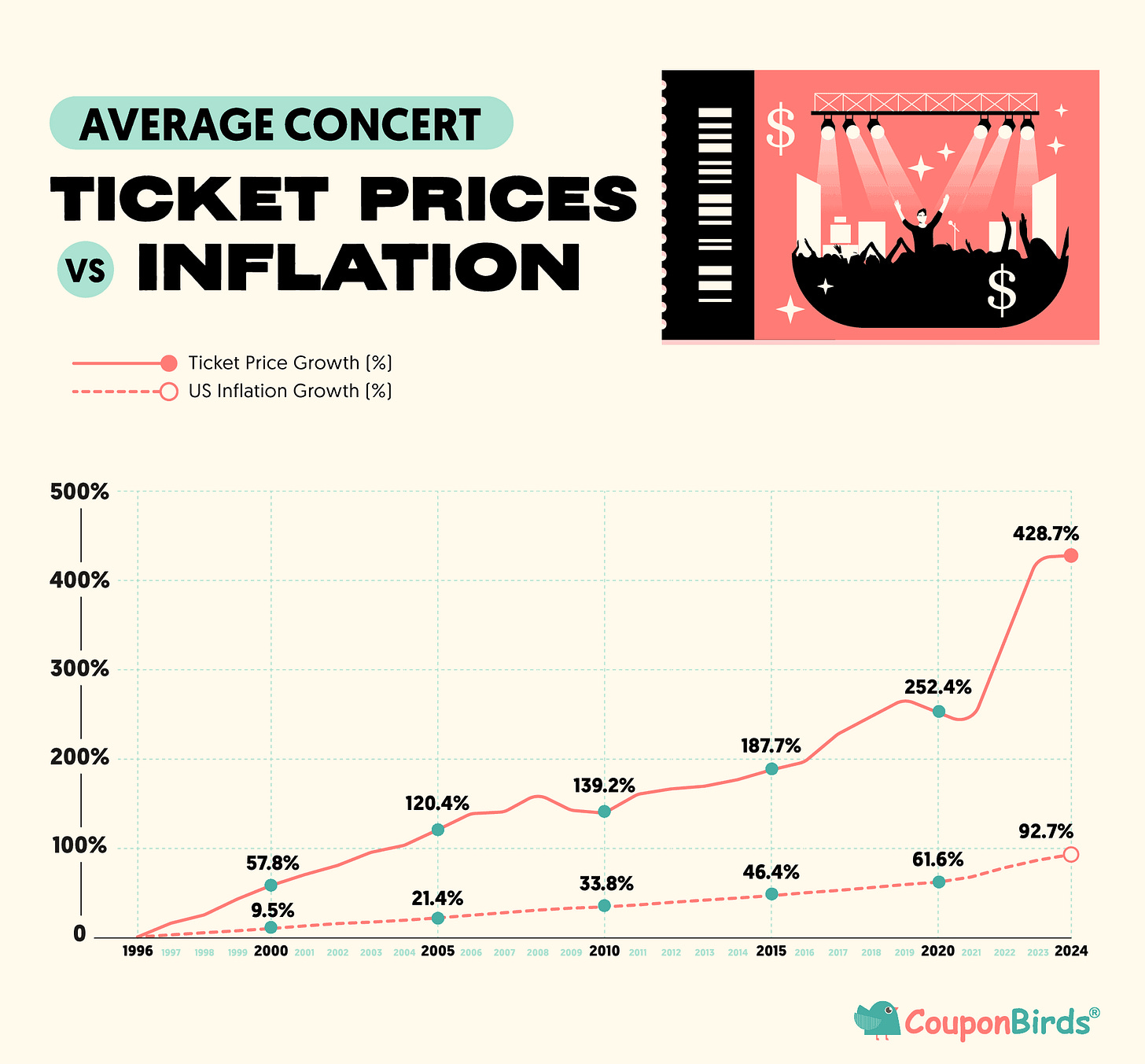

“Your concert tickets are getting more expensive…

And it’s not just because of inflation. Although the cost of concert tickets has been consistently increasing over the years just like many other goods and services, the price of the average ticket rose by nearly 400 percent from 1981 to 2012, far above the 150 percent rise in overall inflation, making concerts feel more like a luxury item, especially as wages struggle to keep up with inflation.

The average price of a concert ticket for the top 100 tours last year was $135.92 – a 41% increase from the average ticket price just five years earlier ($96.17). Dynamic pricing has played a role in that increase, and artists suspected of utilizing the pricing method have faced serious public backlash. A recent example is when Lady Gaga fans reported seeing a minimum ticket price of over $600 for nosebleed seats earlier this year, just 15 minutes into ticket sales (the advertised minimum price was $113.06). Even so, Michael Rapino, CEO and president of Live Nation Entertainment (the parent company of Ticketmaster), has said that tickets are still “massively underpriced”.”

https://businessjournalism.org/2mintip/dynamic-pricing/

Show Tickets

Yes, show ticket prices in Syracuse (and generally) have risen dramatically since 2000, driven by factors like increased artist reliance on touring income, dynamic pricing, fees, and demand, with some Syracuse examples showing massive jumps, like Elton John tickets selling for over $1,800 at the JMA Wireless Dome, a far cry from earlier eras. While specific local 2000 data is sparse, national trends show average concert ticket prices more than doubling by 2010 and continuing to soar, far outpacing inflation. (AI)

A National Trend -

Average concert ticket price around $40.74 in 2000, but rose to $91.86 by 2019, significantly outpacing inflation. (AI)

Friends who recently wanted tickets to an away-from-Broadway production of Hamilton found that the tickets cost $300 each.

Concert tickets prices increased 80.5% since 2021 according to a new study. Since 1996, concert prices ballooned 428.7% from just $25.81 to $136.46.

Aligned with inflation, a concert ticket from 1996 which averaged $25.81 would cost just $49.74 in current dollars. That’s about one-third of what fans pay now and 4.6X inflation, according theCouponBirds analysis.

https://www.hypebot.com/hypebot/2025/07/concert-ticket-prices-increased80-percent-in-3-years.html

Superbowl tickets:

Clearly, affordability is being challenged on lots of different levels, but for people who find themselves working for minimum wage, entertainments others enjoy would seem to be out of reach. If people (consumers) cannot afford to attend events or eat out as often as they did, businesses will fail, people will become more isolated, life will seem grimmer.

There are other entertainments people enjoy such as camping and hiking, playing sports on traveling teams, skiing, water sports. Inflation may be affecting costs in these areas. Check it out on the internet. For now, this closes out my short series on affordability. When our economy is only considered healthy if it grows consistently, without ever losing ground, then fighting inflation could be considered counterproductive. If only the same could be said for wages.